Capital structuring that builds investor trust and closes multi-round deals.

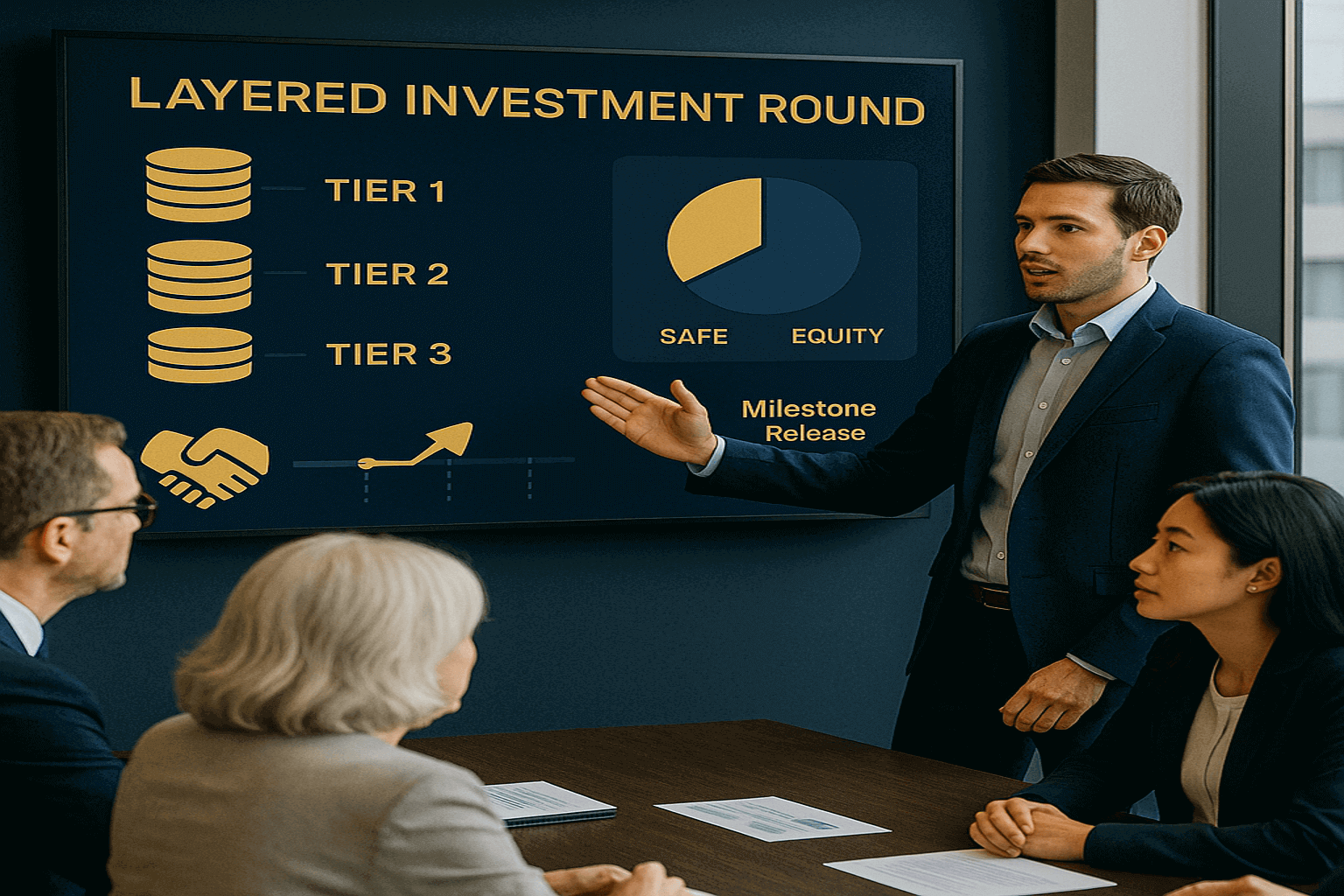

At EIN Business Funding (EINBF), we help entrepreneurs and business owners design funding rounds with clarity, compliance, and confidence. Whether you're structuring your first SAFE round or scaling through Series A or mezzanine capital, we assist with term sheet optimization, equity-debt balance, and capital stack alignment.

Our capital experts serve as intermediaries between your business goals and investor expectations — ensuring that every round is built for growth, not just funding.

We assist with structuring clear, investor-ready term sheets covering valuation, equity, debt, and governance rights.

We design equity/debt blend and staging strategies to support growth while minimizing dilution and risk.

We align your round’s mechanics with the expectations of strategic, financial, and institutional investors.

Connect with our funding team to explore investor-matched capital solutions.

Get Funding SupportExplore common questions about investment round design and term sheet clarity.

EINBF helps serious business owners, investors, and sellers structure funding with precision. Let’s guide your capital journey — from planning to placement.